News & Updates

NCBA Bank Rwanda has announced the appointment of Maurice Toroitich as its Managing Director. The appointment brings to the helm a veteran of the banking industry, whose leadership spans nearly three decades of transformative banking and leadership in East Africa. Maurice is recognized for his pioneering work as the founding CEO of KCB Bank Rwanda,

NCBA has forecasted a steady growth in the country’s GDP with output projected to close at 4.8% in 2024 and remain consistent into 2025. In an economic forum held today, under the theme,”Navigating Uncertainty – Key Trends Influencing the Economic and Business Environment in 2025,” the bank addressed the global and domestic factors influencing Kenya’s

NCBA’s Customer-centric approach ensures customers enjoy full banking services, including digital banking, asset financing, personal and business loans, and advisory services for local businesses and individuals. NCBA has today unveiled a new branch in Ukunda, Kwale County, as part of its local expansion drive aimed at taking the business into new sectors of the economy

The Companies are pleased to announce a strategic realignment of their Boards of Directors following an expansion of their interests and exceptional growth both locally and regionally since the successful merger in 2019 that gave rise to the NCBA Group.

NCBA Group has entered into a strategic partnership with YEN Golf (YENA Africa Ventures) aimed at enhancing the golfing experience for enthusiasts across the region and empowering entrepreneurs through golf skill-building and networking opportunities. The collaboration facilitated through YEN Africa’s golf program, YEN Golf, seeks to provide exclusive discounts to golfers and promote active lifestyles

NCBA Group PLC has posted a profit after tax of KES 9.8 billion in its first half of 2024 financial results which is a 5.0 per cent increase compared to KES 9.4 billion reported during a similar period in 2023.

Consumer, Commercial and SME banking accounts will benefit from the new adjustment. NCBA has today announced they will not charge monthly fees for their retail banking accounts from 1st July 2024. This change will affect existing current account products and new products applicable for incoming customers. The new adjustment will be applicable to consumer banking

Notice is hereby given that the 64th Annual General Meeting (AGM) of the shareholders of NCBA Group PLC will be held via electronic communication on Wednesday, 29th May 2024 at 10:00 am in the manner set out in the notes immediately following this notice for the following purposes:

The Board of NCBA Group PLC is pleased to announce the appointment of Ms. Kathryne Maundu as Group Company Secretary in accordance with the provisions of the Companies Act and following receipt of regulatory approval from the Capital Markets Authority and pending approval from the Central Bank of Kenya. In this capacity, Kathryne will serve

The NCBA Now app offers a comprehensive suite of features accessible anytime, anywhere to both customers and non-customers. NCBA Group has unveiled its innovative banking omnichannel application, NCBA Now, in Tanzania in a bid to enhance digital banking penetration and offer a better overall experience for its customers. The NCBA Now App offers real-time account

Apply Today

NCBA Group, a Leader in the Kenyan financial services sector, has today signed a USD 50 million facility with Proparco a subsidiary of the AFD Group focused on private sector development. The funding will go towards delivering NCBA`s “Change The Story” sustainability agenda. NCBA has a long-standing relationship with AFD Group and continues to evolve

Apply Today

NCBA Business stock loan helps your business to meet your working capital needs through revolving and non-revolving stock loans which are essential for your business growth. These loans cater for your business needs financing that facilitates the purchase of new stock or buffer stock for normal business operations. This loan is available with revolving limits.

NCBA Group in collaboration with Boreka Group and Kitui County has today planted 40,000 seedlings as part of its commitment to conserve the environment under the “Change the Story” initiative, which aims to plant 10 million trees by the year 2030. The tree planting exercise was carried out with the involvement of the community in

The NCBA Chess Team has this afternoon been flagged off to Muscat, Oman for the FIDE World Amateur Chess Championship that will take place from 1st to 12th November 2023. The nine players led by Captain Mourice Obila qualified for the tournament after they won the 2023 Kenya Corporate Chess Championship in June. Speaking during

NCBA has launched a new branch in Wote Town, Makueni County. The branch is located at Mbau Junction Mall and is one of the 10 branches the bank pledged to open this year as part of its expansion strategy to bring financial services to all areas of the country. The branch opening was inaugurated by

NCBA Group PLC (NCBA Group) announces to shareholders and the investing public that the Board of Directors has authorized the commencement of discussions with AIG Group, which could lead to NCBA Group owning 100% of the issued share capital of AIG Kenya (“the Transaction”). NCBA Group currently holds a 33 1/3% shareholding in AIG Kenya.

NCBA Group announces that the Board of Directors has authorized the commencement of discussions with AIG Group to acquire its entire shareholding in AIG Kenya Insurance Company Limited (subject to regulatory approvals). NCBA Group PLC (“NCBA”), today announced its intention to acquire 100% of AIG Kenya Insurance Company Limited (“AIG Kenya”). If concluded, the acquisition

NCBA – KMI Motor Show kicks off by selling out all exhibitor stands through partnering with over 20 car dealerships and auxiliary brands including Kingsway Tyres, Silverstone, Inchcape, Subaru, AutoXpress, Salvador, Tireworld, GB Motors, Crown Motors, Tata International, Simba Corporation, Sairaj Ltd, ISUZU, Mobikey, CFAO Motors and Caetano. We have curated an Immersive and accessible

The penultimate qualifier leg of the 2023 NCBA Golf Series is scheduled to take place this Saturday, September 2nd, 2023, at the Great Rift Valley Lodge and Golf Resort. Over 100 golfers are scheduled to tee-it-off at the resort’s picturesque, yet challenging,18-hole course for a chance to qualify to play in the Series grand finale,

NCBA has opened its newest branch at Kahawa Sukari, further bolstering its presence in the Kiambu region. This strategic expansion aligns with NCBA’s commitment to enhancing its retail business and providing convenient financial services to customers. It brings to 3 the total number of branches opened this year and 90 countrywide. Speaking at the opening,

After a four-year hiatus, The Kenya Motor Industry Association (KMIA) (Chairman: Mr Naresh Leekha and his abled team) are pleased to announce that NCBA – KMI Motor show 2023, will be held from Friday 15th September 2023 to Sunday 17th September 2023, at the Sarit Centre Expo Hall, Nairobi – Kenya. Apart from all active

NCBA has today opened its 85th branch at Chwele Market in Bungoma County in a bid to bring services closer to customers in Bungoma County and the Greater Western Region. Chwele is the newest municipality in Bungoma County and the second-largest open-air market in Kenya after Karatina. The new branch was inaugurated by H.E. Governor

NCBA has today donated and planted over 20,000 trees in Bungoma County at various institutions to mark World Environment Day. As part of the day’s activities, the bank planted 4,000 trees in Kibabii University in an event graced by the Governor of Bungoma County H.E Kenneth Lusaka and H.E. Tessie Musalia, Spouse to the Prime

NCBA Group PLC has posted a profit before tax of KES 6.4 billion in its Q1 results ending March 31st 2023, which is a 32 per cent increase compared to KES 4.8 billion reported during a similar period last year. The Group registered a profit after tax of KES 5.1 billion representing 49 per cent

NCBA and Strathmore Business School have today entered into a strategic partnership that will aim to provide enhanced support and resources to Small and Medium Enterprises (SMEs). The partnership signing agreement marks a significant step towards fostering the growth and success of SMEs, which play a pivotal role in Kenya’s economy. As part of this

Notice is hereby given that the 63rd Annual General Meeting (AGM) of the shareholders of NCBA Group PLC will be held via electronic communication on Wednesday, 31st May 2023 at 10:00 am

The overall year-on-year inflation rate as measured by the Consumer Price Index (CPI) was 7.9 per cent, in April 2023. As presented in Tables 1 and 2, the increase in inflation was largely due to an increase in prices of commodities under Food and Non-alcoholic Beverages (10.1%); and Housing, Water, Electricity, Gas and other fuels

Annual headline inflation registered at 7.9% (7.91%) in April 2023 – a 130.00bps decline from 9.2% observed in March. The decline largely reflected lower prices of fast-growing produce due to the onset of the long-rains. The favorable weather conditions deflated food prices – bringing down annual food inflation from 13.4% to 10.1%, a 330.00bps decline.

NCBA has entered into a leasing deal with D. Light Ltd that will see NCBA Leasing LLP, NCBA’s leasing subsidiary lease 205 automobile units. Under the deal, d.light Ltd, a leading provider of Pay as you Go and solar-powered solutions, will acquire 60 Mini-vans and 145 motorcycles that will be handed over within the next

NCBA in partnership with the Kenya Mortgage Refinance Company (KMRC) has today rolled out a home acquisition initiative that will enable Kenyans own a home at affordable interest rates. The proposition will allow NCBA customers to own homes starting from 9.5% interest rate with up to 25 years of repayment and 105% home financing, with

NCBA Bank in Kenya has today signed an asset finance deal with Deluxe Motors that will see the lender offer up to 90% financing, for Ashok Leyland trucks and buses. The Small and Micro Enterprise sector, which is the largest employer in Kenya, will be the biggest beneficiary of this unique financing partnership, which will

For the past sixteen years, NCBA has invested over Ksh 100 million in the scholarship program with the aim of providing continuous education to underprivileged and bright students from disadvantaged backgrounds. In 2023, the bank has sponsored 100 students with an investment of Ksh 11.1 million for education scholarships. In Kenya, over 1.8 million children

NCBA Bank has today opened a new branch in Utawala, Nairobi County. This brings to 86, the total number of NCBA Bank branches countrywide. This is part of the bank’s ambitious expansion agenda of its retail business aimed at taking services closer to customers. Utawala is one of the fastest growing areas in Nairobi County

Twiga Foods, Isuzu EA and NCBA Bank have today through a strategic partnership, flagged off 15 Isuzu commercial trucks to boost affordability and safe delivery of fresh produce to retailers across the region. The partnership will see up to 300 Isuzu trucks being released into the marketplace in phases. Speaking during the vehicle handover and

In Kenya, the cooperative movement has been a powerful growth engine. It affects practically every area of Kenya’s economy, both formal and informal. It is estimated that 63 percent of Kenya’s population is involved in cooperative-based organizations, either directly or indirectly. It is also understood that cooperatives provide 46 percent of overall GDP, 35 percent

NCBA Bank has, for the third time in a row, been recognized as the preferred bank in asset finance in the banking category at the Transport & Logistics Excellence Awards held at Panari Hotel, Nairobi County on Friday. The Transport & Logistics Awards is an annual event that brings together different stakeholders across various sectors

At NCBA, your convenience matters to us. We have been pursuing a branch expansion strategy to build a bigger and smarter branch network that brings our services closer to you. In 2021, the Bank opened 12 new branches, and we are on track to open a further 11 new branches in 2022. To support our

NCBA bank has today signed a partnership deal with AMREF Flying Doctors to offer discounts to customers using air ambulance and ground evacuation medical emergencies. The one-year renewable deal will see customers enjoy affordable medical evacuation services throughout Eastern Africa region. Countries covered under this deal include – Kenya, Tanzania, Uganda, Rwanda, Burundi, Zanzibar, Ethiopia,

NCBA Group has today launched the 2022 NCBA Golf Series to take place across its regional markets. The 18-leg series will have an expanded schedule covering Kenya, Uganda and Tanzania and will draw the participation of both junior and adult golfers. In Kenya, the tournament will run in partnership with Kenya Golf Union and will

We know that education for your children matters. For them, we know that it is important that they get the best career advice early on as they forge their own path. Whether you are a caring and supportive parent or an intrigued student looking for opportunities for higher learning, we have partnered with Uniserv to

NCBA BANK KENYA PLC DEBIT CARD CASHBACK CAMPAIGN – TERMS AND CONDITIONS 1. INTRODUCTION These terms and conditions apply to the visa debit “card cash bank swipe and win” campaign offered by NCBA Bank Kenya PLC to its customers. 2. DEFINITIONS In these terms and conditions, unless the context otherwise requires: “Bank” means NCBA

The ultimate showdown in the 2021 NCBA Golf Series is set to take place this Friday, December 3, 2021, at the Karen Country Club when the par-72 course hosts the Series’ Grand Finale. The event will be the 23rd on the 2021 NCBA Golf Series Calendar, where 105 players who qualified to play through the

Kenya’s Gross Domestic Product (GDP) is projected to grow by 5.80% in 2021, says NCBA Regional Economic Outlook Report. The growth forecast which is an upward revision to the bank’s initial baseline estimate of 5.3% in May 2021 is supported by a better-than-expected evolution of the public health crisis that continues to support quicker softening

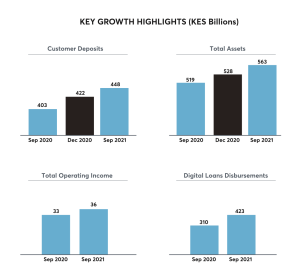

NCBA Group PLC has posted a profit before tax (PBT) of KES 11.1 billion in its quarter three results ending September 30th, 2021. The PBT of KES 11.1 billion is a three-fold increase compared to KES 3.8 billion reported during a similar period last year. The Group registered a nine-month profit after tax of KES

Handicap 26 golfer, Tobias Messo, carded a remarkable round of 41 points on Saturday to emerge the overall winner of the 21st leg of the ongoing 2021 NCBA Golf Series which was held at the scenic Kericho Golf Club. His stellar outing at the event saw him secure a slot to play at the Series’

Owning a home remains a dream for many Kenyans. However, the cost implications have caused many to shy away from homeownership solutions. To address this gap, NCBA has embarked on a 1-year mortgage campaign to lend at 11.9% interest, for all property finance solutions beginning 1st of November 2021. The reduced rate, which was previously

NCBA Bank PLC has today announced a Kshs 2m sponsorship to the Junior Golf Foundation to promote junior golf development in the country. Sponsorship to go towards training of coaches, local tours, provision of training development programmes and nationwide golf development The one-year agreement will go towards the training of coaches, local tours, provision of

NCBA Group PLC and NCBA Bank Kenya have been assigned long-term default rating of B+ with a negative rating outlook by the global credit rating firm, Fitch Ratings. The B+ rating is a result of the standalone creditworthiness of the Group on the back of limited probability of sovereign support. The negative outlook corresponds to

Handicap 16, Steven Njoroge, carded a round of 39 points on Saturday to emerge the overall winner of the Great Rift Valley Golf Resort’s leg of the ongoing NCBA Golf Series. He becomes the series’ 15th overall winner and joins a team of over 70 other players who have booked their place to play at

11-Year-Old junior golfer, Mumbi Gatu, carded an impressive round of 49 points to emerge the overall winner at the Limuru Country Club’s leg of the ongoing NCBA Golf Series. The handicap 50 player becomes the second junior golfer to claim the overall winner’s spot in the Series after twelve-year-old Nathan Mwangi who claimed the overall

NCBA Bank in partnership with Safaricom have today launched a campaign to support M-Shwari customers. The campaign dubbed “Pamoja na M-Shwari” comes at a time when most Kenyans are working to rebuild as the country continues to recover from the effects of the Covid-19 pandemic. The three months campaign will have two key offers:

The Karen Country Club will this Monday, August 23, 2021, and Tuesday, August 24, 2021, host the first of two junior golf tournaments being undertaken by NCBA Group as part of its ongoing 2021 Golf Series. A field of 85 junior golfers will take to the Karen course for a chance to battle it out

Kiambu Golf Club’s Charles Karanja Mbugua was crowned the tenth winner of the ongoing 2021 NCBA Golf Series after he emerged winner of his Club’s leg of the Series on Saturday. The handicap 24 players carded a round of 43 points to claim the top spot, on countback, ahead of Dr. Paul Kaumbutho (Handicap 12),

NCBA Bank has today partnered with a service provider, MySafe Vaults Limited to offer alternative safety deposit facilities to customers in Nairobi. Under the new partnership, customers who had limited access or lack of safety deposit facilities at the bank will be recommended with an alternative solution. The pact will also see the service provider

Investing in long-term financial assets is the key to successful wealth accumulation and preservation for your future. Most Kenyans begin to think about their future in their early 40’s when retirement is looming. However, with the youth in Kenya making up two-thirds of the population, young Kenyans are thinking about their financial future now. A

The Kenyan middle and lower classes all desire to tap into short-term investment opportunities. Investors are often not looking to wait for several years to multiply their returns but are simply looking to fulfill their short-term plans like for purchasing an asset, funding education, or financing a vacation for the family. However, with limited savings

NCBA Bank has today launched a product that will provide home buyers with a one-stop shop for all construction solutions. Through NCBA EasyBuild, the lender has engaged a consortium of service providers that will support customers to design and build their dream homes. The consortium consists of project managers, architects, interior designers, quantity surveyors, structural

NCBA Bank Kenya PLC has today signed an asset finance deal with Simba Corp that will see the lender finance up to 95% of all commercial and personal vehicles sold by Simba Corp. In a bid to ease the financial load in the current business environment, new and repeat customers will in addition enjoy discounted

Home golfer, Anand Patel, carded a round of 42 points on Saturday to secure the overall win of NCBA Golf Series at Nyali Golf and Country Club in Mombasa County. His impressive performance saw him fend off the charge by Nilesh Patel, who carded 40 points to claim the top spot in the men’s category,

Kenya’s Gross Domestic Product (GDP) is projected to recover to 5.3% in 2021, says NCBA Economic Outlook report. The report by NCBA Group attributes this growth to increased activity in education (32%), construction (7.3%), ICT (7.7%), health (6.0%) and agriculture (4.0%) sectors. According to the report, some upside will stem from a low base and

NCBA Bank Kenya PLC and DT Dobie have today signed a six months’ partnership to jointly promote sale of Mercedes Benz and Volkswagen brand of vehicles. Under the partnership, NCBA will provide up to 95% financing with up to six years loan repayment period. The partnership will also offer a discounted loan-processing fee at 2%

NCBA Bank Kenya PLC has today launched a logbook loan product that will enable Kenyans access up to 50 % financing against an owned vehicle. Under this financing solution, Kenyans will be able to borrow funds against a vehicle that they already own provided the vehicle is not under any financing. Upon application, customers will

NCBA BANK KENYA PLC DEBIT CARD CASHBACK PROMOTION – TERMS AND CONDITIONS Introduction These terms and conditions apply to the visa debit “card cash bank swipe and win” campaign offered by NCBA Bank Kenya PLC to its customers. Definitions In these terms and conditions, unless the context otherwise requires: “Bank” means NCBA Bank Kenya PLC;

Tax – it can be a confusing topic. And if you’re a business owner, it’s important that you understand the various taxes you need to pay so you don’t get any penalties. We organized a webinar with Alpha Tax and Business Advisory Services to help you understand taxes!

NCBA Bank Kenya PLC has today signed a partnership deal with Tata Africa Holdings (K) Limited to finance Tata models throughout the country. Under the deal, customers will be able to acquire a Tata range of commercial vehicles with up to 95 percent financing from NCBA Bank for up to 60 months. In addition, buyers

Kenya’s leading commercial vehicle assembler Isuzu East Africa and Kenya’s leading asset financier NCBA Bank have unveiled a vehicle purchase and leasing program that will give schools access to buses at favorable and flexible terms in a plan crafted to support post Covid-19 economic recovery efforts. In collaboration with the Kenya Private Schools Association (KPSA),

Good Morning and a happy new year! I wish to begin by thanking you all for honoring our invitation for the launch of NCBA 2021 Golf series. Today marks the beginning of a tour to 20 golf clubs across the country as highlighted by the Group Director: Marketing, Communications & Citizenship Rosalind Gichuru. Thika Sports

NCBA Bank has signed up a partnership with Shelter Afrique to provide mortgage finance to buyers in five counties. Under the agreement, NCBA will offer mortgage finance to over 200 housing units developed by Shelter Afrique and spread across Nairobi, Mombasa, Kisumu, Kiambu and Machakos counties. The developments include maisonettes and apartments ranging from Ksh 5.5

NCBA has today rolled out a creative brand campaign that will demonstrate the real-life impact of its brand promise on its customers. Dubbed Numbers That Matter, the campaign is the customer’s story of real life meaning behind the financial services solutions they have received. Numbers that Matter is anchored in the fundamentals of the NCBA

The Board of Directors’ of NCBA Group PLC and NCBA Bank Kenya PLC (the Companies) hereby announce the following changes within the Board and Management of the Companies

Prior to the outbreak of COVID-19 Pandemic, Kenya’s economy was strong expanding by 5.4% in 2019. Growth is projected to decline to 2.6% in 2020 due to the adverse impact of COVID-19 but rebound to 5.3% of GDP in 2021. The post-COVID Economic Recovery Strategy currently under development puts great emphasis on the role of

NCBA Bank has today, through its Change the Story initiative, launched a one million indigenous tree nursery at Karura Forest. This was done in partnership with Kenya Forest Services (KFS) to help inspire change by protecting our environment through tree planting. NCBA has invested Kshs 13 million towards the project as part of its reforestation

NCBA has committed KES 100 million to help the fight against the COVID-19 pandemic. The funds will go towards the government’s COVID-19 Emergency Response Fund, which was set up by H.E. President Uhuru Kenyatta to mobilize resources to support the fight against this pandemic. The contribution to be made by NCBA will go towards humanitarian

NCBA Group PLC and Safaricom have today introduced measures following the Government of Kenya directives in support of the collective efforts to manage the socio-economic impact of coronavirus (COVID-19), in the country. In a show of solidarity, as Kenyans grapple with the consequences of this pandemic, the two institutions have committed to provide relief to

NCBA Bank held its inaugural Economic Forum following the merger between Commercial Bank of Africa Limited (CBA) and NIC Group PLC (NIC) on Thursday, February 6th, 2020. This is a quarterly platform that was launched in January 2018 by the former CBA and it facilitates public and private sector conversations on emerging policy issues that

As part of our commitment to uplift our fellow citizens, we are honoured to partner with the Palmhouse Foundation in their 2020 scholarship initiative. The Palmhouse Foundation helps students from underprivileged backgrounds secure educational scholarships. For many, education is the tool to empower themselves and their families to live a more comfortable life. We have

NCBA is proud to have been recognised by the Kenya Revenue Authority (KRA) for its contribution to tax payment during the annual Tax Payer’s Day on November 5, 2019. NCBA registered impressive revenue growth and embraced reform initiatives, thus registering highest corporation tax yield and growth in the financial year 2018/2019. We are humbled by

1st November 2019 marked the official opening of our NCBA branches across Kenya and we could not be more excited to provide unprecedented financial services to all our customers. This new chapter has unlocked our collective potential under the eminent leadership of our Kenya Chairman, Isaac Awuondo and Group Managing Director, John Gachora. Our footprint

Win big when you swipe your NCBA debit and credit cards or make an online transaction of over KES 5,000. Stand to win in weekly draws including local holidays, point of sale rewards and vouchers, as you earn entry points into a draw with a grand prize of an all-expenses-paid trip to Dubai for two.

NCBA Insurance is your door to a wide range of insurance products at affordable premiums. Protect all the things you have worked hard to acquire and provide all-round protection to you and your family with policies provided by the best insurers.

Get rewarded for banking with NCBA Bank. We’re giving you discounts of up to 40% off on lifestyle, travel and shopping vendors when you use your NCBA Visa Card. We have partnered with local and international airlines, hotels, online shopping platforms, and more to give you more value than you can find anywhere else.

Tuesday, 22nd October 2019…Listed financial services group, NCBA Group PLC, has listed 793.8 million new shares on the Nairobi Securities Exchange following the merger of NIC Group PLC and Commercial Bank of Africa Limited (CBA) earlier this month. The merged entity will trade as NCBA at the NSE. The previously listed entity, NIC Group’s issued

NIC GROUP PLC AND COMMERCIAL BANK OF AFRICA LIMITED MERGER RECEIVES FINAL APPROVAL FROM CENTRAL BANK OF KENYA GROUP HOLDING COMPANY WILL BE KNOWN AS NCBA GROUP PLC The Central Bank of Kenya and the National Treasury have granted approval for the merger of NIC Group PLC (NIC) and Commercial Bank of Africa Limited (CBA).

NCBA credit cards offer unparalleled value with competitive pricing, favorable repayment terms and interest-free periods. Prepare for the unexpected and make your money go further with our tailored card offers, available in Kenya Shillings or USD.