NCBA Opens Utawala Branch As It Seeks To Tap Into The Property Sector And SME Markets

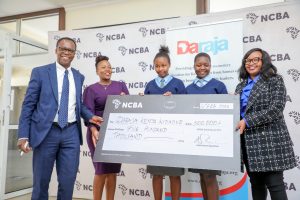

NCBA Bank has today opened a new branch in Utawala, Nairobi County. This brings to 86, the total number of NCBA Bank branches countrywide. This is part of the bank’s ambitious expansion agenda of its retail business aimed at taking services closer to customers.

Utawala is one of the fastest growing areas in Nairobi County that is characterized by infrastructural development ranging from residential to commercial properties and with a growing urban population.

Speaking during the official opening of the branch, Pauline Ndote, Group Director, Credit Management, NCBA Group, said that “This was a strategic decision to bring our services closer to the people of Utawala as this area continues to hold great potential to continue being a property development hub.”

“At NCBA we are looking to lend to our customers who are seeking to acquire, construct or finance the property, our mortgages home loans of up to 105% of the value of the property. Through this offering, we have made home ownership easy and we are ready to make people’s dream of owning a home a reality. With this offering, Utawala serves to be a strategic area to tap into.

Kenya’s housing demand is expected to dramatically shift in the next few years and with it, a growing demand for innovative financing solutions to bridge the widening housing gap.

The current outlook of the property market in Kenya states that housing is one of the fastest-growing sectors; with a rate of 4.2 per cent every year. This is an indication of the need for adequate housing in the country

Ms Ndote also noted that this latest branch will be key to supporting the local businesses in the area by offering personalized banking solutions.

“At NCBA we understand the significance of SMEs to economic growth, innovation, job formation and to social cohesion. We recognize that SME lending is not only one of the most economically important but also one of the most profitable contributors to banking revenues. This new branch will provide the people here in Utawala with different banking solutions – credit to grow businesses, asset finance, corporate, business and retail banking. Our goal is to improve SMEs’ access to finance and find innovative solutions to unlock sources of capital for them to ensure their financial success.”

NCBA bank is the leading bank in asset financing and digital business, with a market share of more than 35 per cent in asset finance. The Group intends to continue scaling up its branch network in 2022 by opening 11 new branches by the end of the year, bringing its services closer to customers.